At Christensen & Jensen, we provide estate planning services for clients ranging from seniors to business owners to younger people getting established in life. We take time to understand our clients’ lives, families, and main objectives to create customized and adjustable estate plans that provide peace of mind and confidence in meeting future challenges. We also serve estate personal representatives (a/k/a executors) and trustees in probate and trust administration after the death of a loved one. Our attorneys are experienced in dealing with special circumstances, such as offering detailed estate planning for business owners, providing extra attention and service for seniors, and guiding trustees and personal representatives through challenging estate administrations involving real estate, businesses, and delayed probate situations.

We work with estate planning and probate clients in Salt Lake City and across Utah and the U.S.

ESTATE PLANNING, TRUST, & PROBATE ATTORNEYS IN UTAH

Estate planning is a very important and personal matter that should be carefully customized to meet a person’s individual needs and circumstances. Regardless of whether one is wealthy or of modest means, your family should understand your wishes and be equipped with written directions to carry out your directives if die or become incapacitated and are unable to manage your own affairs. Thorough and carefully prepared estate planning will help you and your family effectively follow through on how you want your affairs and assets managed and distributed.

Every person is different with unique challenges and opportunities. That’s why Christensen and Jensen attorneys provide expert legal counsel, custom-tailored to your personal needs and situation.

Christensen & Jensen estate planning and probate law attorneys have experience working with clients in a variety of circumstances, including:

- Business owners

- Seniors, including seniors needing in-home consultations and document-signing meetings

- Professionals

- Clients in second marriages and/or with blended families

- Family members with special needs

- Disposition of real estate owned in trust or subject to probate

- Planning for legacy assets, such as family cabin properties

- Probate of business assets, including “illiquid” businesses owning substantial assets

- Coordination of life insurance and retirement plan accounts with trusts and wills

Christensen & Jensen’s Estate Planning, Trust, & Probate Services in Utah

Estate Planning, Trusts, & Wills

A well-designed estate plan, based on either a trust or a will, is necessary to provide the directions family members and others need to carry out your wishes and to provide for your loved ones.

The most effective plans also provide directions for how you will be cared for and how your assets will be managed if you become incapacitated. Without such planning in place, it can be chaotic and very stressful for loved ones to determine how to deal with your affairs and property. It is even more important to have planning in place if you have minor children or other dependents who rely on you.

Our firm has deep experience in providing business owners and seniors with customized counsel and planning needed to address their unique circumstances.

Our services in this area include:

- Revocable living trusts and wills

- Power of attorney (POA) and other documents necessary for establishing authority over assets during incapacity

- Trust planning focused on minimizing estate and gift taxes

- Planning for difficult family situations

- Planning for clients without children or grandchildren

- Irrevocable trusts, including GRATs, IDGTs, and other trusts helpful for reducing taxes

- LLC formation & LLC operating agreements specially drafted to manage and pass on family properties and assets

- Cabin property trusts

- Prenuptial agreements

- Charitable trusts and other planned giving solutions

- Supplemental (Special) needs trusts for disabled family members

- Customized trust planning for clients in second marriages and/or with blended families and other unique situations

- Wills and estate planning for parents of minor children

- Updated or new estate planning for clients who have moved to Utah

- Counsel regarding owning property jointly with other people

Probate & Trust Administration

When a loved one has died, we counsel and provide representation of trustees and estate personal representatives (a/k/a executors) dealing with trust and/or probate administration, including representation in probate court.

While in many cases trust and probate administration goes smoothly, sometimes because of challenging kinds of assets or family member situations, estate administration proves to be very difficult. If you are the responsible trustee or personal representative, we can guide you all the way through the trust or probate administration process to ensure that things are done correctly and efficiently, and reducing the stress of such important responsibility.

Our services in this area include:

- Drafting and filing all pleadings necessary for probate administration in court

- Legal counsel for trustees and personal representatives to help them understand governing documents and applicable trust and estate law and perform required tasks

- Representation of trustees and personal representatives in dealing with difficult surviving family members and creditors of the trust or estate

- Representation and counsel pertaining to assets and properties that are difficult to deal with, including businesses, real estate, and retirement accounts

- Strategies for resolving trust and estate disputes and litigation

- Ancillary probate of estate assets located in other states

Business Succession Planning

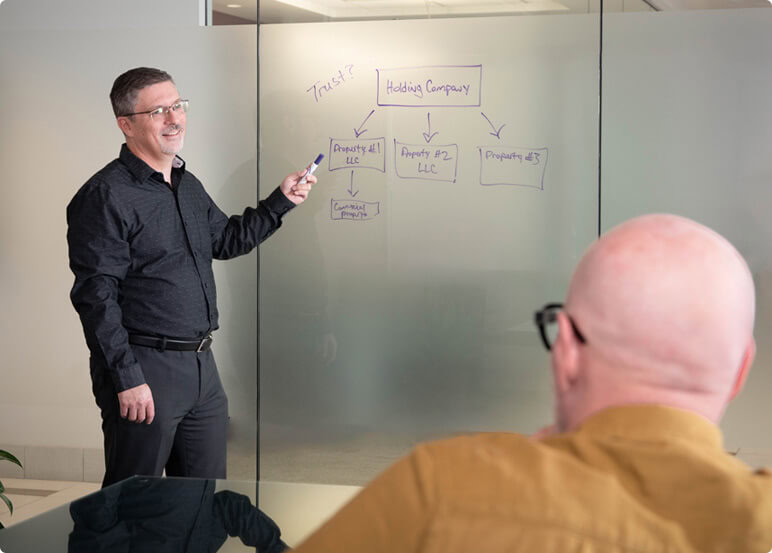

One of the most challenging kinds of estate planning pertains to business ownership. Our attorneys have special training and experience in helping business owners effectively coordinate their estate planning with transferring business ownership on to family members or key employee, including planning designed to ensure the business owner receives the business value the owner has worked so hard to create, often over many years.

We can help you analyze and make planning decisions pertaining to your company’s value, who you want to succeed in ownership, and document and agreements needed to ensure that your business ownership is transferred just as you intend, whether it happens on your intended timeline, or as a result of your death or serious health issues.

We can help with:

- Business continuity planning

- Customized trusts and wills specially-designed to deal with and transfer business assets

- Power of attorney (POA) documents drafted to give trusted family members or others authority over businesses in case of the founder’s incapacity or serious health issues

- Counsel regarding use of life insurance and other funding tools useful for transferring business ownership and producing fair distributions of wealth among both business-active and non-active family members

- Estate and gift tax planning

- Coordination of buy/sell, corporate and business entity governing documents with the founder’s estate planning

CHRISTENSEN & JENSEN’S TRUSTS & ESTATES ATTORNEYS

REVIEWS

Request a Consultation

"*" indicates required fields

Frequently asked questions

How do I write a business succession plan?

text

How do you protect your personal assets?

text

How do you register a business in Utah?

text

Why is corporate governance important?

text

How do I register a trademark name?

text

What is the difference between a transactional lawyer and a litigator?

text

Why a business should have a lawyer?

text

Why would companies need legal counsel?

text