Workplace discrimination is illegal, and if you work in Utah, you have rights.

Few things are more stressful than feeling mistreated at work and not knowing whether what’s happening is actually illegal or just unfair. Employment discrimination laws can feel confusing, especially if you’ve never dealt with it before.

This guide breaks down Utah workplace discrimination laws so you can understand:

- What does and does not qualify as discrimination

- What protections Utah and federal law provide

- What steps you should take if you believe discrimination is happening

- When to talk to an employment attorney

Whether you’re currently employed, were recently fired, or are considering filing a complaint, this article is designed to help Utah employees understand their options.

What Is Employment Discrimination in Utah?

Employment discrimination occurs when an employer treats you differently because of a protected characteristic, such as:

- Race or color

- National origin

- Sex (including pregnancy, sexual orientation, and gender identity)

- Religion

- Disability

- Age (40 or older)

Under both Utah law and federal law, employers may not:

- Refuse to hire you

- Fire you

- Demote you

- Reduce pay or benefits

- Create worse working conditions

Protection From Retaliation in Utah

A secondary important right you have is the right to not be retaliated against.

This means your employer cannot punish you for:

- Reporting discrimination

- Requesting accommodations

- Complaining about unequal treatment

- Participating in an investigation

How Are Employment Discrimination Laws Enforced?

Although discrimination by an employer is illegal, that doesn’t mean that anyone is going to be arrested for it. Anti-discrimination laws created government agencies like the Equal Employment Opportunity Commission (EEOC) and the Utah Antidiscrimination and Labor Division (UALD), which are tasked with protecting employees’ rights to be free from discrimination. The laws also give state and federal government agencies, attorneys general, and individuals like you the right to sue employers in civil court if the employer violates an antidiscrimination law.

In other words, your legal protections are already in place, but you may have to file a lawsuit and get a court involved for those protections take effect.

Important Limitation: Small Employers in Utah

One important thing to note: if your employer has fewer than 15 total employees, you probably won’t be covered by most anti-discrimination laws. The laws were written to leave employees at small businesses outside of the protections.

An employment attorney can help determine whether your employer is covered.

What Does Discrimination in the Workplace Look Like?

Who Can Discriminate?

Who Can Discriminate?

Discrimination can come from:

- Supervisors or managers

- The employer directly

- Coworkers, customers, or third parties

If your boss knows about discriminatory treatment from a coworker, a business associate you’re required to work with, or a customer, they can be responsible for that discrimination if they do not do anything to stop or prevent it.

Who Is Protected Under Utah Law?

- People of all races and national origins

- Men, women, transgender, and nonbinary employees

- Employees age 40 and older

- Employees with disabilities

- People of any religion or none

What Is Not Considered Discrimination?

Ordinary workplace toxicity, personality clashes, miscommunications, and poor treatment by your boss are usually not considered discrimination, unless they are also related to a protected category listed above. It’s not illegal for a boss to be a jerk; it only crosses the line into discrimination when your boss is being a jerk to you because of an inherent part of you that you cannot change.

Ordinary workplace toxicity, personality clashes, miscommunications, and poor treatment by your boss are usually not considered discrimination, unless they are also related to a protected category listed above. It’s not illegal for a boss to be a jerk; it only crosses the line into discrimination when your boss is being a jerk to you because of an inherent part of you that you cannot change.

How Do You Prove Workplace Discrimination?

Direct Evidence

Direct evidence of discrimination is something like a racial slur being directed at you by your boss, or an employer saying something explicit, like “I didn’t hire you because you’re a woman, and I don’t hire women.” This kind of evidence of discriminatory intent is rarer to experience, but even now it still happens.

Harassment

Courts do not like to provide one-size-fits-all formulas for how to describe (sexual, racial, disability-based, etc.) harassment. However, the key words are “pervasive” and “severe.”

- Pervasive harassment is a harassment that may be minor but is frequent to the point of being constant.

- Severe harassment is extremely bad behavior, such that even if it happens once can create a hostile work environment.

Negative behavior doesn’t have to be both pervasive and severe to be discrimination. If you face treatment that is both happening all the time and seriously upsetting, you could have a strong case for harassment.

Quid Pro Quo

The Latin term “quid pro quo” means “something for something.” When talking about sexual harassment, quid pro quo refers to sexual favors demanded by an employer or supervisor in exchange for better treatment at work.

What your superior offers in exchange could include:

- Keeping your job

- Receiving a promotion or bonus

- Protection from other sexual harassment

- Special treatment

How Do I Know If Discrimination is Happening to Me?

Think about your work situation and ask yourself:

- Is a coworker treating you poorly, more because of who you are than because of what you do?

- Does your boss ignore the obvious harassment against you?

- Is your workplace causing serious emotional distress?

- Do you need therapy or medical care because of work conditions?

These are some indications you might be facing workplace discrimination, and it may be time to talk to an attorney.

Should I Go to HR?

Proceed with caution.

HR’s main job is to reduce legal risks to employers. So long as your interests as the employees line up with the employer’s interests, HR might seem like they’re on your side and want to make you happy and healthy. However, as soon as the employer decides, e.g., that your harasser is more valuable to the company than you are, HR is likely to turn on you.

You improve your chances of solving the situation or having a strong case later if you report issues to your employer and create a paper trail of the continued harassment. This will allow you to take things up the chain of command one rung at a time until someone solves it or doesn’t, which would lead you to pushing the situation further.

Be mindful of your conduct at work. Failing to follow instructions or appearing uncooperative can give an employer a legitimate, non-discriminatory reason to terminate your employment. Even when you are experiencing discrimination, it is important to remain polite, professional, and cooperative whenever possible. Doing so helps protect you from giving your employer an excuse to discipline or terminate you under the guise of “performance” rather than retaliation.

Best Practices for Utah Employees Facing Discrimination

Lawyers cannot give legal advice to anyone who isn’t their client. However, these are some general best practices that I have seen clients do to improve their outcomes.

Lawyers cannot give legal advice to anyone who isn’t their client. However, these are some general best practices that I have seen clients do to improve their outcomes.

Document Everything

Even when nasty treatment happens to you at work, it is often really hard to remember the details later. What day was it exactly when she called me that name? Was it before or after my birthday? Taking notes with dates, times, witnesses, and feelings about the situation can help you remember to tell your story accurately later.

DON’T QUIT

If you quit, even if it feels like you had to do so under duress, a court will likely not agree that you had no choice. It becomes much harder to make the case that you were fired illegally if the official record says you “voluntarily” resigned.

Read Everything Before You Sign

If you sign a paper (digitally too!), you’re agreeing to whatever it says. Just because you didn’t read it carefully (or at all) will not protect you from being bound by the terms written there. This is particularly important when you agree to “waive,” or give up, your rights, such as the right to sue your employer.

Legal documents are often written in complex, legalistic language. They are sometimes even written in a small font size or have weird formatting that makes it harder to read. Don’t be discouraged; take your time to read it through and try to understand it yourself. If you don’t understand it, contact a lawyer for advice.

Ask For Copies of Everything

There is no reason for an employer to deny you access to your own paperwork and employee file. Be polite, but assertive, in asking for copies of any document you’ve signed. Keeping track of such documents can be very important to your case.

Track Medical and Therapy Expenses

One category of damages that you can recover in a lawsuit against a discriminatory employer is “consequential damages.” These include any costs you had to pay as a result of the discrimination. This often includes therapy bills. Keep track of the bills you have had to pay because of the discrimination against you.

Get Help from a Utah Employment Attorney

Your rights as an employee are time-limited. Missing a deadline can mean losing your claim entirely.

If you believe you’re facing workplace discrimination in Utah, Christensen & Jensen can help evaluate your situation and explain your options. Request a consultation today.

This kind of situation can really be unpleasant, but it’s often not discrimination. If it’s not because of you being a member of one of the listed protected classes, it’s not discrimination. Yes, or to HR. Creating a record of your complaints can be crucial if you later need to sue, and in the moment a report gives the employer the chance to fix the situation if they can. Yes. Utah is a one-party consent state. As long as you are a participant in a conversation, you can record it without notifying the other parties to the conversation. Don’t spy on anyone from a hiding spot, but you can record your own conversations without telling anyone. However, these kinds of recordings can be difficult to review, so if you do make audio or video recordings, try to organize and prioritize them as you go. FAQ'S about Discrimination in the Workplace

Information You Should Obtain

Information You Should Obtain It’s critical you maintain documentation of:

It’s critical you maintain documentation of:

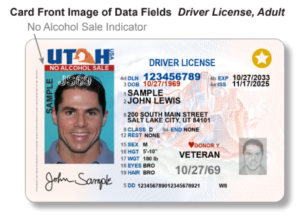

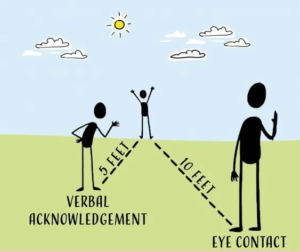

Utah Restaurants With Bars: The 5-Foot and 10-Foot ID Rule

Utah Restaurants With Bars: The 5-Foot and 10-Foot ID Rule As the new year begins, moments of reflection have a way of catching us off guard, even in unexpected places. When HBO’s new show The Pitt premiered, I tuned in partly out of loyalty to my alma mater, the University of Pittsburgh, and partly for the nostalgia for a city I grew to love. Although the familiar skyline caught my attention, what stood out was a storyline rooted in a very real dilemma about end-of-life medical decisions.

In the episode, a patient with Alzheimer’s disease arrives at the ER in respiratory distress. His advance directive rejects mechanical ventilation, yet his adult children, who both hold durable power of attorney, disagree. His son wants to follow the directive, but his daughter urges intubation. The physician notes that intubation would cause suffering and undermine the patient’s autonomy, but could ease the family’s emotional burden. Ultimately, the children override their father’s wishes. The episode offers no clear resolution. Instead, it leaves viewers with a question that is especially worth considering at the start of a new year:

Can a surrogate decision-maker’s authority outweigh the patient’s clearly stated preferences?

As with most ethical dilemmas, the “right” choice is rarely clear, but such conflicts can often be avoided through advance planning, specifically by understanding the difference between a living will and a health care directive. In Utah, the Uniform Health Care Decisions Act merges a living will and medical power of attorney into one standardized document. This was designed to reduce ambiguity and minimize disputes between a patient’s instructions and a surrogate’s authority.

As the new year begins, moments of reflection have a way of catching us off guard, even in unexpected places. When HBO’s new show The Pitt premiered, I tuned in partly out of loyalty to my alma mater, the University of Pittsburgh, and partly for the nostalgia for a city I grew to love. Although the familiar skyline caught my attention, what stood out was a storyline rooted in a very real dilemma about end-of-life medical decisions.

In the episode, a patient with Alzheimer’s disease arrives at the ER in respiratory distress. His advance directive rejects mechanical ventilation, yet his adult children, who both hold durable power of attorney, disagree. His son wants to follow the directive, but his daughter urges intubation. The physician notes that intubation would cause suffering and undermine the patient’s autonomy, but could ease the family’s emotional burden. Ultimately, the children override their father’s wishes. The episode offers no clear resolution. Instead, it leaves viewers with a question that is especially worth considering at the start of a new year:

Can a surrogate decision-maker’s authority outweigh the patient’s clearly stated preferences?

As with most ethical dilemmas, the “right” choice is rarely clear, but such conflicts can often be avoided through advance planning, specifically by understanding the difference between a living will and a health care directive. In Utah, the Uniform Health Care Decisions Act merges a living will and medical power of attorney into one standardized document. This was designed to reduce ambiguity and minimize disputes between a patient’s instructions and a surrogate’s authority.

Despite its name, a living will has nothing to do with your property, your bank account, or who inherits your record collection. A living will is a written statement outlining your wishes for medical treatment if you are unable to communicate and your condition is terminal or irreversible.

This is where you specify whether you’d want life-sustaining treatments such as:

Despite its name, a living will has nothing to do with your property, your bank account, or who inherits your record collection. A living will is a written statement outlining your wishes for medical treatment if you are unable to communicate and your condition is terminal or irreversible.

This is where you specify whether you’d want life-sustaining treatments such as:

A lease, also known as a contract, lays the foundation of your rental agreement. Although Utah generally allows for both written and oral rental agreements, Utah Code Ann. § 25-5-4 requires certain agreements to be in writing. For example, § 25-5-4(1)(a) states that an agreement that lasts more than a year is void unless it is in writing.

A lease, also known as a contract, lays the foundation of your rental agreement. Although Utah generally allows for both written and oral rental agreements, Utah Code Ann. § 25-5-4 requires certain agreements to be in writing. For example, § 25-5-4(1)(a) states that an agreement that lasts more than a year is void unless it is in writing. A landowner may evict you for reasons such as:

A landowner may evict you for reasons such as: So, you’re an entrepreneur with the next big idea? Maybe you’ve already started brainstorming logos, looking at locations, or thinking about hiring new employees. While the idea stage might be the most exciting part of bringing your business to life, an equally important part is fulfilling the legal requirements surrounding entrepreneurship in Utah. This article walks you through five essential legal to-dos, from choosing a business structure to registering for taxes, so you can move forward with confidence.

So, you’re an entrepreneur with the next big idea? Maybe you’ve already started brainstorming logos, looking at locations, or thinking about hiring new employees. While the idea stage might be the most exciting part of bringing your business to life, an equally important part is fulfilling the legal requirements surrounding entrepreneurship in Utah. This article walks you through five essential legal to-dos, from choosing a business structure to registering for taxes, so you can move forward with confidence. Step 2: Register Your Business and Name in Utah

Step 2: Register Your Business and Name in Utah Step 3: Understand Utah Business Taxes

Step 3: Understand Utah Business Taxes  Step 5: Build Your Legal and Financial Foundation

Step 5: Build Your Legal and Financial Foundation

A Utah criminal defense attorney’s role is to advocate for people going through the hardest moments of their lives, that means navigating not just the legal system, but the human emotions associated with their case.

A Utah criminal defense attorney’s role is to advocate for people going through the hardest moments of their lives, that means navigating not just the legal system, but the human emotions associated with their case. One of the most strategic decisions in a trial is whether to have the client testify.

One of the most strategic decisions in a trial is whether to have the client testify. For those who imagine the courtroom as a stage for flashy arguments and dramatic wins, Jonathan Nish’s story is a reminder: the best defense attorneys are often the ones who work quietly but relentlessly, building trust, preparing thoroughly, and standing firm when it matters most.

For those who imagine the courtroom as a stage for flashy arguments and dramatic wins, Jonathan Nish’s story is a reminder: the best defense attorneys are often the ones who work quietly but relentlessly, building trust, preparing thoroughly, and standing firm when it matters most.

We’re proud to announce that in The Best Lawyers in America 2026 Edition:

We’re proud to announce that in The Best Lawyers in America 2026 Edition: